In the intricate world of business, making the right financial decisions can be the difference between prosperity and peril. Navigating the complex terrain of finance requires a keen understanding of risk management, investment strategies, and sound financial planning. This is where financial advisory services step in, offering a guiding hand to individuals and businesses alike. In this article, we explore the critical role of financial advisory in maximizing profits and minimizing risks.

The financial landscape is a dynamic and ever-changing domain, shaped by economic fluctuations, market trends, and regulatory developments. In such an environment, financial decisions are multifaceted and require a comprehensive understanding of various factors.

Challenges in Financial Decision-Making

Risk Assessment: Assessing the potential risks associated with financial decisions is paramount. Poor risk management can lead to significant losses.

Investment Choices: Identifying suitable investment opportunities that align with one’s financial goals can be challenging, given the multitude of options available.

Market Volatility: Financial markets are susceptible to fluctuations, which can impact investment portfolios and business operations.

Tax and Regulatory Compliance: Staying compliant with tax laws and financial regulations is crucial to avoid legal issues and penalties.

Retirement Planning: Planning for retirement involves complex financial strategies to ensure a comfortable and secure post-working life.

Opportunities in Financial Decision-Making

Profit Maximization: Well-informed financial decisions can lead to profit maximization through strategic investments and effective financial management.

Asset Diversification: Diversifying investments can help spread risk and optimize returns, especially in volatile markets.

Wealth Preservation: Effective financial planning can help preserve and grow wealth for future generations.

Tax Efficiency: Strategic tax planning can minimize tax liabilities, leaving more funds available for investments and other financial goals.

Retirement Security: Proper retirement planning ensures financial security during one’s golden years.

The Role of Financial Advisory Services

Financial advisory services encompass a wide range of expertise designed to assist individuals, families, and businesses in making sound financial decisions. Here are the key aspects of how financial advisors contribute to maximizing profits and minimizing risks:

1. Personalized Financial Planning

Financial advisors work closely with clients to create personalized financial plans tailored to their specific goals and circumstances. These plans encompass budgeting, savings, investments, and retirement planning.

2. Risk Management

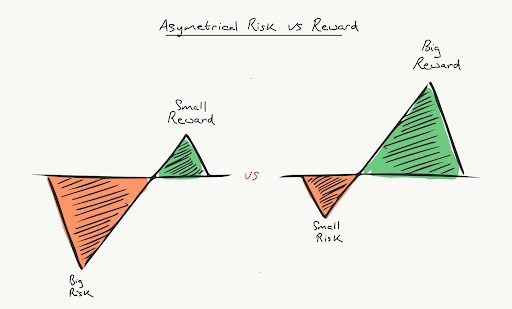

Assessing and mitigating risks is central to financial advisory services. Advisors help clients identify potential financial risks and develop strategies to minimize exposure.

3. Investment Strategy

Advisors provide guidance on investment choices, considering factors such as risk tolerance, time horizon, and financial objectives. They assist in building diversified portfolios that align with clients’ goals.

4. Retirement Planning

Planning for retirement involves calculating future financial needs, optimizing savings, and selecting suitable retirement accounts. Advisors ensure that clients are well-prepared for their retirement years.

5. Tax Optimization

Financial advisors offer strategies to optimize tax efficiency, helping clients reduce tax liabilities and make the most of available tax deductions and credits.

6. Estate and Wealth Transfer

Advisors assist in creating estate plans and wealth transfer strategies to ensure that assets are preserved and passed on to heirs as intended.

7. Market Insights

Advisors stay informed about market trends and economic developments, providing clients with valuable insights to make informed investment decisions.

Realizing the Benefits

Now, let’s explore the tangible benefits that individuals and businesses can derive from partnering with financial advisory services:

1. Informed Decision-Making

Financial advisors provide clients with the knowledge and insights needed to make well-informed financial decisions.

2. Risk Mitigation

Through risk assessment and management strategies, advisors help clients minimize potential financial losses.

3. Investment Diversification

Diversifying investments spreads risk and can lead to better returns over the long term.

4. Tax Savings

Strategic tax planning can result in significant tax savings, allowing clients to keep more of their hard-earned money.

5. Retirement Security

Effective retirement planning ensures that clients can enjoy a financially secure retirement.

6. Wealth Preservation

Advisors help clients preserve and grow their wealth, providing for current and future financial needs.

7. Time Savings

By outsourcing financial planning and management, clients save valuable time and can focus on their core activities.

Choosing the Right Financial Advisor

Selecting the right financial advisor is essential to realizing the full benefits of financial advisory services. Here are some considerations when making your choice:

Credentials: Ensure that the advisor holds relevant certifications and licenses.

Experience: Look for advisors with a proven track record and experience in handling situations similar to your own.

Transparency: Seek advisors who are transparent about their fees and potential conflicts of interest.

Client References: Request references or client testimonials to gauge the advisor’s effectiveness.

Communication: Choose an advisor who communicates clearly and listens to your financial goals and concerns.

Alignment with Objectives: Ensure that the advisor’s approach aligns with your financial objectives and risk tolerance.

In conclusion, financial advisory services play a pivotal role in helping individuals and businesses navigate the complexities of the financial landscape. By partnering with knowledgeable advisors, clients can maximize profits, minimize risks, and secure their financial future. The right financial advisor acts as a trusted partner in achieving financial success and prosperity.